Informatica – $INFA – IPO’d today. What do you need to know about this data-management software provider? Could this be the next cloud play?

The Story of Informatica

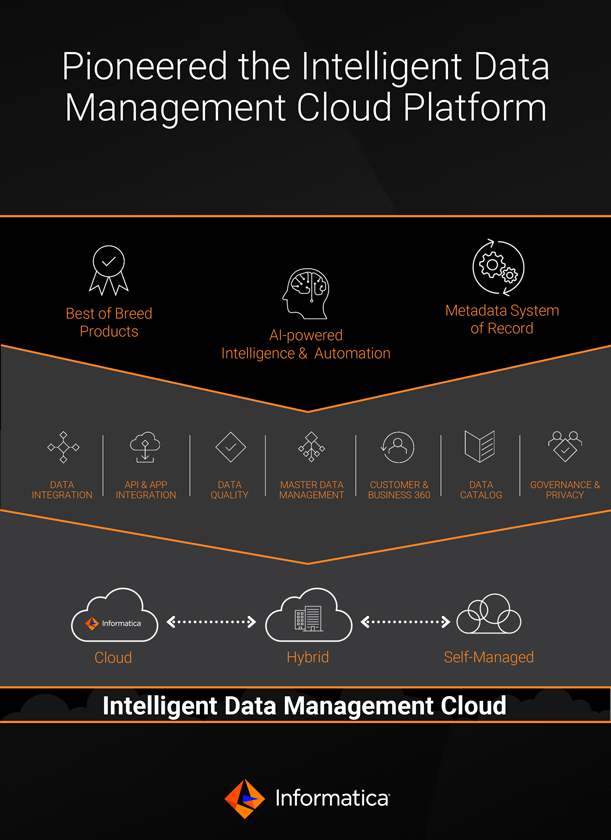

Informatica provides data integration products including data visualisation, data masking and data replica tools. It’s in 5 Gartner magic quadrants. It counts the likes of Unilever, Kroger, Sanofi and the US Air Force among its client base. This is a quick overview of its features:

Informatica has been public before! It was public for 15 years. In 2015, private equity firm Permira and the Canada Pension Plan Investment Board took Informatica private, in a leveraged buyout that valued it at $5.3bn.

So why did it go private? To transform the business. It made the difficult decision to sacrifice short-term growth for long-term moving over to what we know to be generally the more successful business model.

The logic is echoed in the stories of other major technology companies that have gone private in recent times, including BMC and Dell. It’s also seen by companies like Nutanix – $NTNX – who experienced a very bumpy period in the stock while making the switch.

Did it work? The numbers say yes. The company now draws 95% of all net new business revenue from software subscriptions, up from 31% in 2016.

Since then, it has also moved from providing primarily on-premises solutions to cloud-based, software-as-a-service offerings. Cloud is now its chief revenue driver and growing at 40% year on year.

Now, it IPO’d for a second time. Why? It will use the funds to pay off the heavy debts it took to finance the move private in 2015. According to its Securities and Exchange Commission filing, Informatica reported net debt of $2.77bn as of 30 June.

The S-1 Analysis

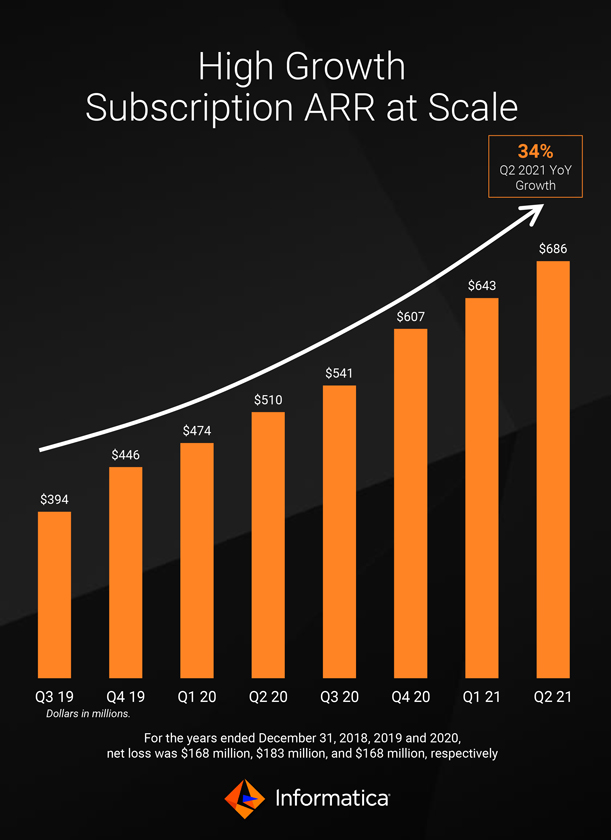

The company has been growing subscription ARRs at 34%. It has $1.24B Q2 2021 Total ARR And $686M of that is Subscription ARR $264M of that is Cloud ARR. But, it is still not profitable.

It is a product rocket. The growth rates are decen, plus, in the first half of 2021, it spent more on product development than sales & marketing. That is promising.

The company is targeting enterprises: really big businesses which have thousands of places that they are actually generating data and possibly 100s that are being stored.

As more and more of these enterprises undergo “digital transformation,” Informatica will continue to benefit. So it is part of a growing market with tailwinds.

Should you invest?

The bull case is:

- Company is now subscription SaaS

- Growing problem that it solves

- Gross margin is in the 70% range

- Product rocket

The bear case is:

- Almost 10x sales and not a fast growing, young SaaS play

- Still not profitable. Having to spend a lot to grow despite good gross margins

So, what do you think? Did you invest today? Will you invest in the latest new cloud SaaS company on the market?

Sources: Check out the S-1 here & 3 other great places of info: