If you had to pick a single pandemic stock, Square might have been it. A relatively counter-intuitive pick given the primacy of its offline card reader business, Square gained about $80B in market cap between February 2020 and February 2021.

But where the rise is swift, so tends to be the fall. Square was no exception. It has lost about 35% of its enterprise value in the intervening 10 months:

Then, on Monday Jack Dorsey – founder and CEO of both Square and Twitter – declared he was stepping down as CEO from Twitter. By Wednesday, Square had rebranded to Block. The markets respond to actions more than words, and Square has continued its short-term downtrend.

But what does Square’s rebrand to Block mean for the future of the company? As the third most valuable fintech company globally, behind PayPal and Intuit, Square sets the tone for the industry. What does the rebrand mean for fintech broadly?

Jack is Doubling Down on Blockchain

Jack has long been a proponent of Bitcoin. And he has had a dramatic impact on its history. The Cash App has introduced millions of users to the currency. In addition, Square’s support of blockchain generally has helped legitimize the space.

This year, he was a keynote speaker at the Bitcoin conference. Here is the segment where he explains why Bitcoin changes everything, alongside Elon Musk and Cathie Wood:

But as CEO of Twitter, Jack was unable to focus on making Bitcoin more than an investment. And, as an investment, it is a questionable one to suggest for the Cash App user base, which is primarily low income and living paycheck to paycheck. Bitcoin has had a strong historical return, but it has also had substantial volatility along the way.

As Block, Jack’s Fintech company will be become more like Alphabet. Like Google is the cash cow driving Alphabet, Square will still be the cash cow driving Block. But, in the new structure, Block will be able to more clearly incubate and grow its constellation of “other bets,” which it calls “building blocks.” This might help it create interesting, new, innovative, and lucrative businesses like Alphabet has with Waymo and Home.

Specifically, Block will now become an umbrella technology company with bets across:

- Square, the seller business

- Cash App, the consumer financial products business

- Afterpay, the BNPL solution it acquired

- TIDAL, the music streaming service it bought from Jay-Z

- Spiral, the company’s crypto initiative, including

- TBD, a decentralized exchange

Block’s Decentralized Exchange: TBD

At the heart of Block’s plans lies TBD, a decentralized exchange. The company announced tbDex and published the white paper earlier this year. That white paper provides the clearest illustration of the company’s intentions. The goal of the project is:

A framework for creating on-ramps and off-ramps from systems of fiat to cryptocurrency, without the need for going through centralized exchanges

This is the same problem that all decentralized exchanges attempt to solve. Today, users of cryptocurrency have to go through a byzantine labyrinth of steps to convert fiat US dollars into bitcoin through a centralized exchange, like Cash App or Coinbase. Decentralized exchanges, of which Uniswap is the leading player, offer a peer to peer solution.

TBD has outlined a specific solution:

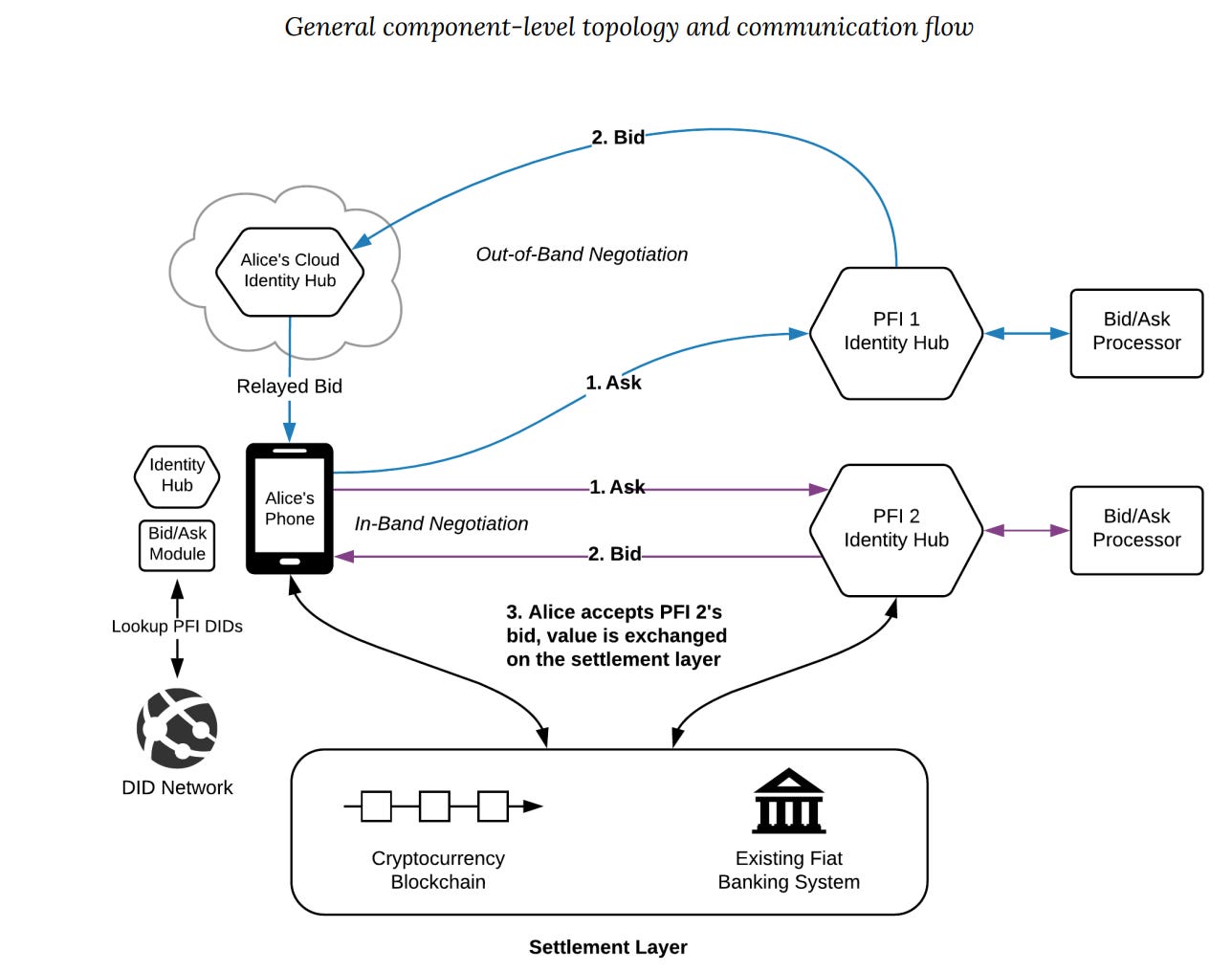

It looks complex, but is a fairly simple three step mechanism:

- Alice, who wants to convert some USD into Bitcoin would start this process on her phone with an ask. That will be sent to Participating Financial Institutions (PFIs) for Bid/Ask processing.

- A bid will be returned to Alice’s phone, where she is given options from the different PFIs.

- She will choose a bid, after which value is exchanged on the settlement layer. The system will coordinate identity through a Decentralized Identifier (DID) network.

There is nothing particularly innovative here. The team has put names on groups and drawn a complex diagram. But once implemented, this business could turn out to be quite lucrative for Square. Uniswap’s 0.3% fee that is generated to liquidity providers is on a run rate for $22 billion in yearly revenue. Square did over $9 billion in revenue in 2020. While some of this revenue may come at the expense of Cash App’s bitcoin revenue, it represents an overall larger pie.

Significant questions remain about TBD’s vision. The current thought for the team is to build this Bitcoin native, as Mike Brock, the GM of TBD shared:

This would be a big departure from the other major DEXes, which are built on layer 1 smart contract protocols like Ethereum, Solana, and Cardano. Instead, it would use the RSK layer 2 solution. This technical design choice stems from the overall mission of Block’s blockchain initiatives, which brings us to the next section.

Making Bitcoin More Than an Investment: Spiral

To the chagrin of many web3 bros, Jack to date has represented a nearly Bitcoin maximalist perspective on blockchain. As a result, TBD is focused on building a DEX atop Bitcoin, just as Cash App has enabled investment only in Bitcoin. Indeed, the goal of Spiral is, “making bitcoin the planet’s preferred currency.”

Spiral is a continuation of Jack’s maximalism. In particular, the company intends to focus on making Bitcoin “more than an investment.” What this means, as of yet, is still in the air. The Spiral website provides the high-level direction it is heading, though.

First, and the area where there is more clarity, Spiral will be funding other open source efforts to improve Bitcoin. It has two programs: Crypto Grants for Everybody, focused on development, and Crypto Designer Grants, focused on design. Its first grant was $100K to the BTCPay Foundation in support of BTCPay Server. BTCPay server is a merchant checkout solution to allow checkout with Bitcoin with 0% fees & no third-party.

With respect to building, the initial focus is Bitcoin development. The Spiral team is hiring three engineers. Their focus will start with the Lightning Development Kit (LDK). The LDK aims to enable a new payments infrastructure atop Bitcoin by enabling pre-existing wallets to operate with Lightning capabilities, which are lower fees and faster transactions at higher scale.

This shows a clear roadmap for Spiral at the start: decentralized payments. While the DEX disrupts Cash App’s bitcoin onramp, the payments onramp disrupts one of Square’s primary cost centers: existing centralized financial rails. A skeptic might call this the Square seller business funding Bitcoin core development. But this is really reducing that seller business’ costs in the long term. It disrupts Mastercard and Visa, who exact a 1-2% tax on credit card rails today.

Square is one of the most valuable and fastest growing tech companies out there. That was solely on the back of its existing businesses. With the positive directions I expect TBD and Spiral to take Square, I reckon its announcement of a rebrand to Block represents a potential large positive change in the trajectory of its revenue and earnings growth.

Precipitating More FinTech web3 Investment

Square has been the trend setter in global FinTech:

- Creating the first mass-market small merchant card reader

- Being the first Super FinTech App in the US with Cash App

- Being one of the first to add Bitcoin to its SuperApp

Now, every FinTech from PayPal to Revolut is adding Bitcoin as an investment option. The same can be expected with investment into decentralized finance.

Other big Fintech players are bound to follow Block’s foray into web3. It is now merely a matter of when, not if.

Reminder: I am just a newsletter writer. This does not represent my employer, and is not investment advice.