- Nissan Deliveries 2020 – 4.1M. Market Cap – $20B.

- Kia Deliveries 2020 – 2.6M. Market Cap – $30B.

- Hyundia Deliveries 2020 – 3.7M. Market Cap – $44B.

- Rivian Deliveries 2020 – 0. IPO Market Cap – $55B

A breakdown of the 4th largest IPO ($RIVN) of the decade:

THE RIVIAN STORY

FOUNDING.

The story begins with RJ Scaringe. He grew up in Florida, where he would work on cars with his neighbor, and spend much of his time outdoors hiking and exploring. A smart guy, he went to MIT to study engineering.

PIVOT.

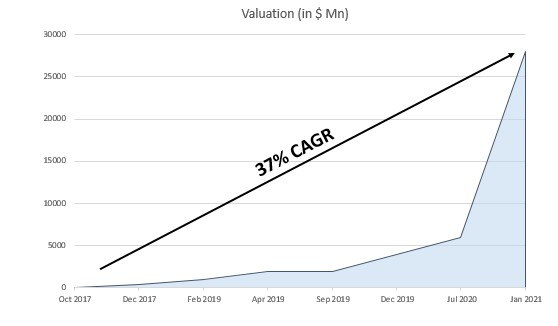

The company actually started working on a 2×2 hybrid coupe. Like all great companies, it made a change as it got market signals. In 2012, the company pivoted to its now famous pickup truck strategy. Since then, the valuation has grown very quickly.

MAJOR HYPE.

The company has been a darling since it won a contract from Amazon for 100K cars. The company differentiates through: 1. Focus on an electric pickup 2. Focus on the commercial, in addition to personal, market

DELIVERIES FINALLY.

In September, it finally had some deliveries. The plan is 1K by the end of this year. But so far all cars were delivered to employees.

So, how are the cars? So far, they are more expensive and less performant than Tesla. Their attractiveness is more in their utility-specifcity, whether that is adventure pickup or delivery van. In that way, they are very attractive adventure pickups:

That does help justify the valuation…

IPO VALUATION

THE NUMBERS.

The company is trading compared to the crazy EV car makers, which trade on a “fraction of possibility of becoming Tesla ($1T mkt cap).” But you could buy 5 other EVs for Rivian

Rivian would even be worth more than:

- Xpeng $XPEV at $40B which will deliver 100K EVs this year

- As well as NIO $NIO at $68B which will deliver over 100K EVs this year

Rivian will be in the range of Lucid – $LCID – at $59B. Lucid delivered its first car a few days ago. So, $RIVN is in line with the other hyped US EV company.

PROSPECTS.

$AMZN is expected to buy $200M MORE shares at IPO. They know what they are doing. That is probably reason enough the company is worth more than Lucid.

Personally, I’m bearish. The valuation is too high. I would rather own the five smaller players. I think that these pre-delivery EV makers need to prove it with deliveries.