This Softbank backed Indian InsurTech play is going public – shouldn’t you know the story? Last year alone, it recorded 126 million unique visits to its website.

The Story of PolicyBazaar

A successful IIT, IIM, Insead, and Bain alumnus, Yashish Dahiya knew his way around financial statements. So, when he was going through his father’s books, he was stunned by a finding: they had been cheated for 100s of thousands by crooked insurance agents

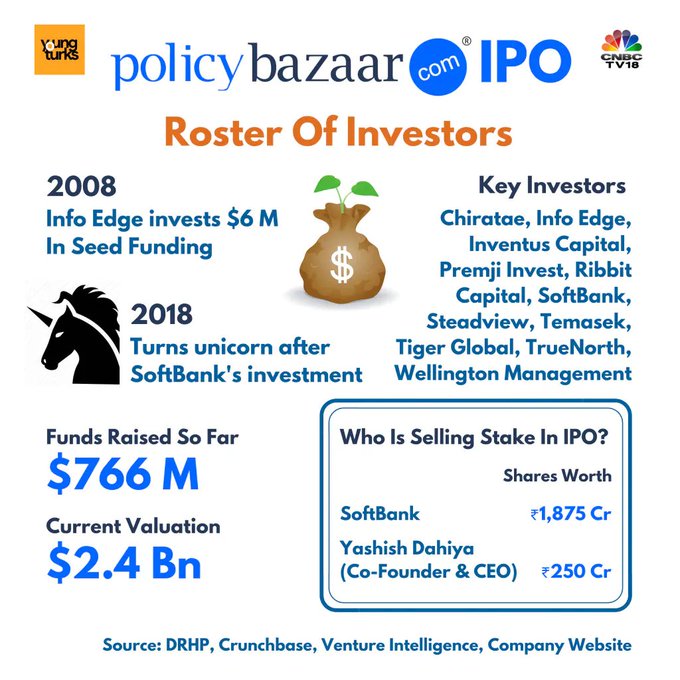

In 2008, together with his co-founders, who had worked on aggregating travel, Yashish began PolicyBazaar to aggregate options and provide people with fair coverage. This went well – for a time. The founding team had serious credentials and horsepower.

But, in 2011, the industry watchdog restricted the money PolicyBazaar earned on leads and commissions. “This regulation basically said you can earn a certain amount and that amount made the business unviable,” said Yashish. It was an existential crisis for the business.

Like all great businesses, the company made adapted. It started converting leads to sales so that it would earn revenue It worked: FY12-FY16, policies sold per month grew from 40k to 600k PolicyBazaar raised $780M funding in 14 rounds, including from Softbank:

Analysis of IPO

In 2020, Policybazaar was India’s largest digital insurance marketplace with a 93.4 percent market share based on the number of policies sold. PolicyBazaar has been evangelical getting India insured: running feature TV shows, conducting explainers, marketing heavily.

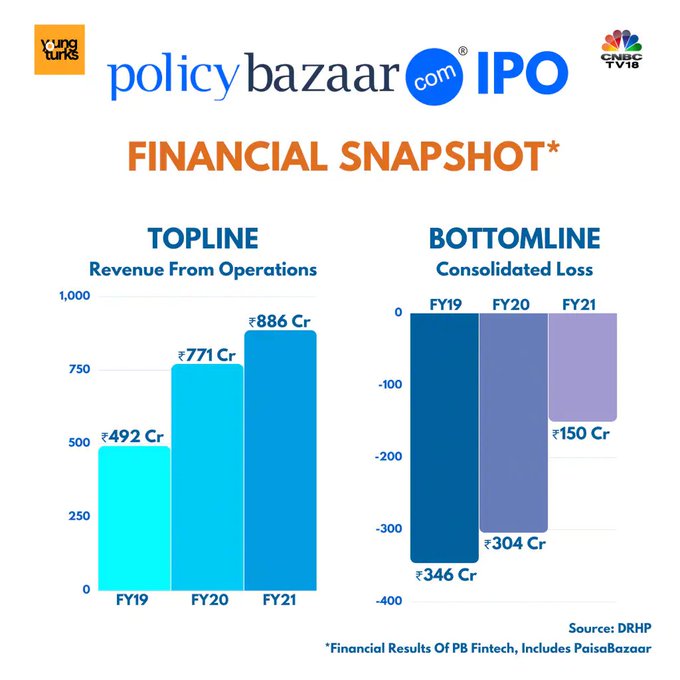

As a result, like many IPO-bound startups, PolicyBazaar is loss-making In the year, an Insurance Regulatory Authority of India slapped PB with a hefty fine But, overall revenue has doubled during the pandemic period.

The bright side is that losses have narrowed, as the company clawed back advertising and marketing expenses from 70 percent of revenue in FY19 to 41 percent in FY21:

The future is bright for PB. India’s life insurance industry is expected to grow at 5.3 percent CAGR between 2019 and 2023. But PB has several other startups to compete with, including CoverFox and EasyPolicy. PB is planning to grow into the Middle East (already in UAE) & Southeast Asia.

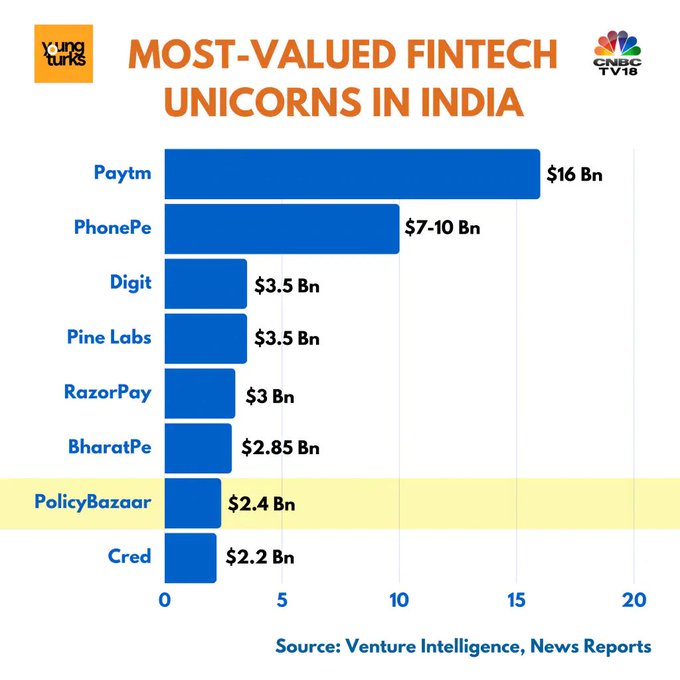

Valuation

The company most recently had a $2.4B valuation. The IPO is pricing at above $5B for a Price to Sales ratio of about 42. That is steep.

- Lemonade, growing more quickly, trades at 49x

- Thai insurance aggregator TQM trades at 11x

- London-listed MoneySuperMarket 4x.

The company is listing under the name PB Fintech Private Limited. It will be publicly available on November 15th.

Will you be investing? They sell nearly 25 percent of India’s life insurance. Just that alone makes it an amazing business worth buying on a dip in my book.

Sources: CNBC, Filing