Takeaways:

- Free Fire is the largest known game in the world, with over 100m daily active players

- It is in one of the fastest growing segments of the gaming market, Southeast Asian Battle Royale on mobile

- Revenue is catching up to impressive engagement numbers: as a result, Sea’s enterprise value (stock price) >20x since the beginning of 2019

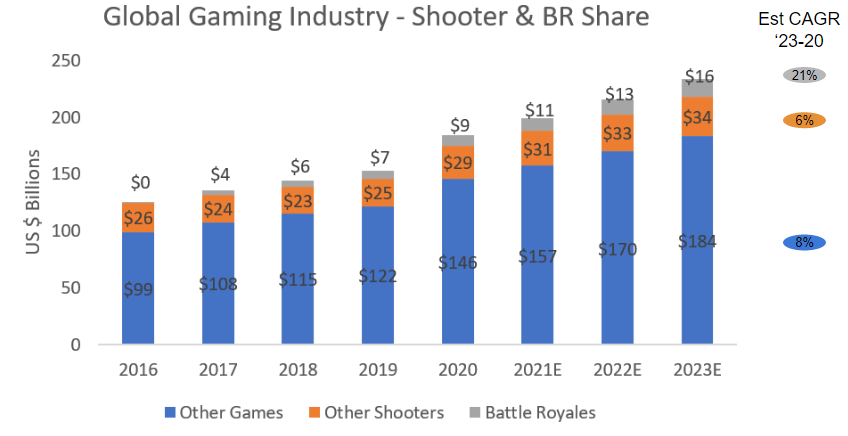

Fast Growing Market Segment

The shooting genre has always been amongst the biggest in dollar terms in video games. The last few years, battle royale has turned the genre on its head. Former stalwart franchises like Halo & Call of Duty have had to contend with the rise of new competitors like PUBG, Apex Legends, and, of course, Free Fire. These battle royale players have eaten up larger and larger portions of the shooter market share.

Notes: Model my own, source data from Newzoo, App Annie, and Sensor Tower public blog posts & company IR pages: no proprietary or pay-walled data used; model created as such data has not been published publicly elsewhere

Based on my estimates, this is one of the fastest growing segments of the overall gaming market. I expect it to grow ~21% / year for the next three years. One of the reasons for this continued growth is mobile. Originally primarily generating cash from console and PC, thanks to the massive success of games like PUBG Mobile and COD Mobile, battle royales are generating significant mobile revenue in Europe and North America. In China, Game of Peace is a mobile battle royale leader.

In Southeast Asia, Free Fire is the leader. Because of the game’s geographic focus, sometimes it can get lost in the gaming media and industry’s relentless focus on big Western titles. But Southeast Asia is forecast to be one of the fastest growing video game regions in the coming years, in addition to Free Fire being in one of the fastest growing segments of the gaming market.

Insane Playership

As gaming companies know, monetization tends to follow engagement. The tougher part is building up engagement. Free Fire has done the tough part. It has built a battle royale that is mobile first, with shorter play times, smaller games (50 vs 100-200 in other games), a smaller map, and no issues playing with folks who have superior inputs (since it is mobile only, there are no controller or keyboard mouse players available to dominate).

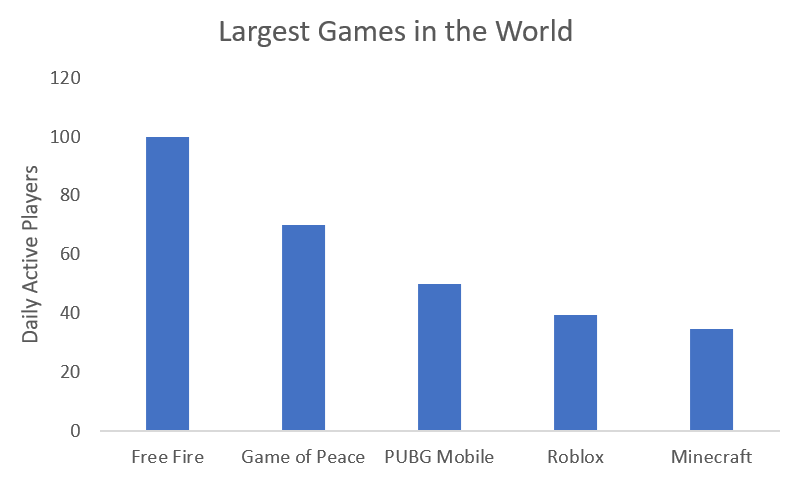

As a result, the numbers this game are delivering are unlike anything else on the planet. App Annie announced that Free Fire was the most downloaded mobile game in 2020. Its’ daily active users are unlike nearly any other game on the planet, at nearly 100 million DAU in August 2020, the last time we were given an official number by the company. At that time, worldwide google trends interest was 65. Now it is 87, so we can expect that number to have grown. At its prior rate, the game has grown at an annualized DAU CAGR of 248% (from 13m in May 2018 to 100m in Aug 2020)! This makes even Roblox’s insane 80% annualized growth rate (admittedly over a much longer timeframe) look normal. But neither of those growth rates are close to normal in gaming.

Free Fire sits atop the throne, as far as we know, of gaming daily active players:

Source: Largest games, based on public estimates for DAP

Monetization Improving

The one area where Free Fire continues to come short is revenue. It plays in areas of the world where monetization is considerably lower. As a result, its numbers have traditionally lagged other shooters. But that is changing fast. The game is gaining traction in the west. According to Sensor Tower, Free Fire ($100M) has surpassed PUBG Mobile ($68M) and Call of Duty Mobile ($62M) to be the highest grossing mobile game in the US in Q1.

Free Fire has made strides to grow monetization in its core regions as well. Garena has invested in aligning with movie actors in top markets, like Hrithik Roshan for India pictured below. This is an area Garena should continue to focus on.

Source: Free Fire website

Rewarded in the Public Markets

The public markets have taken notice. Sea Limited, the parent company of Garena, has nearly 22x’d since the start of 2019. This stock growth is incredibly impressive and reflects the amazing playership growth we went over earlier. Sea has also used the proceeds from Free Fire to fuel aggressive expansions into other games in South East Asia (it holds rights to Tencent games that work in China in the region), payments, and e-commerce. As a result, investors are pricing it something like the Paypal, Amazon, and Roblox of Southeast Asia:

Source: Google Stocks

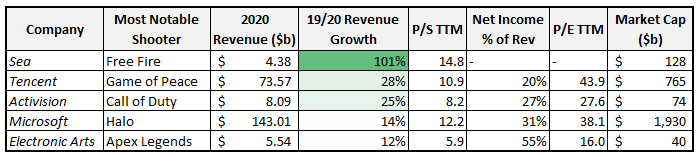

At $128B, we can be certain that market cap is not all about Free Fire. But enterprise comparisons are all we have: like Free Fire lives inside the larger Sea, most shooters live inside of much larger entities. So, they are extremely tough to compare – but we can at least compare those in common metrics:

Source: Company IR pages, atom finance

Clearly, Sea is one of the fastest growing gaming stories (even if it is not pure play) that you can own in the market — participating in the largest segment of the market, shooters, and in the fastest growing segment within that, mobile battle royales in Asia. It has a hefty 15x sales multiple to support that story. So, you will have to pay up. But if you believe the company can catch its monetization up to its impressive engagement, that bet should pay off. As it ramps up its investment in trends like esports, I expect its growth to continue.

Additional Reading

Free Fire/ Sea

- One Esports: How Free Fire became the worlds’ most popular battlegrounds game

- Esports Observer: The Secret Behind Garena Free Fire’s Growth? It’s the Price of Your Phone

- Sea: Investor Relations

Gaming Market

- Game Refinery: Shooter Genre Snapshot Report

- Newzoo: Games

- Sensor Tower: Blog

- App Annie: Blog