Note: I am currently employed by Affirm. At the time I published this post, I was not an employee of Affirm. My opinions are my own and not that of Affirm or its affiliates.

One of the hilarious commercials this Super Bowl was from a relatively unknown FinTech, Klarna. With this ad, the company help put a spotlight on the Buy Now, Pay Later industry to nearly 96.4 million viewers:

Klarna is actually the highest-valued private fintech in Europe. With the IPO of Affirm (NASDAQ:AFRM) popping to a $30B valuation in the United States (>40x consensus sales), investors across the world have also grown more interested in this corner of the FinTech space (we last talked about InsurTech).

Just what is Buy Now, Pay Later; who are the players; and what are the needs they are solving for consumers and merchants? Let us dig in.

The Buy Now, Pay Later (BNPL) Space

Trends Driving BNPL

Three key trends continue to push forward the growth rate of this market: 1. Alternatives Stink, 2. E-commerce continues to grow, and 3. Provider network effects. BNPL is expected to reach $347B globally by 2025.

1. Alternatives Stink: Credit Cards and Payday Loans

Who wants to be in debt to the credit card company, with their ambiguous and outrageous rates, crazy late fees? Not just you. Indeed, in a study by the Motley Fool, 39% of users who chose a BNPL solution did so to avoid using credit cards, the #1 reason to use BNPL. Credit cards reap $120B in deferred interest, and $15B in late payment/ overdraft fees from US consumers yearly.

Payday Loans are no better, although they offer the same deferred payment in small increments, with their price gouging and notoriously unfriendly consumer repo departments. They often charge up to $15 per $100 borrowed, a 400% APR for a two-week loan. These rates are far higher than BNPL for most consumers.

2. E-Commerce Continues to Grow

US retail e-commerce sales reached 14.5% of total retail sales, to $710B in 2020 thanks to acceleration from the pandemic. By 2024, e-commerce sales are predicted to reach 18.1% of total sales, or $1.076T in 2024. E-commerce sales are especially suited for the marketing and proposition of BNPL providers. You are already filling out your information electronically; BNPL and its terms represent fairly low additional burden. (Of course, BNPL providers are focused on physical retail as well.)

3. Provider Network Effects

The business model that probably best represents BNPL is actually marketplace. As the provider gets more businesses to offer the solution, more consumers use and become aware of the solution, prompting more merchants to use or accept the solution. This means that BNPL businesses benefit from network effects as a result of scale, and helps them achieve exponential instead of linear growth (the now not-so-secret investing method of Ark Innovation).

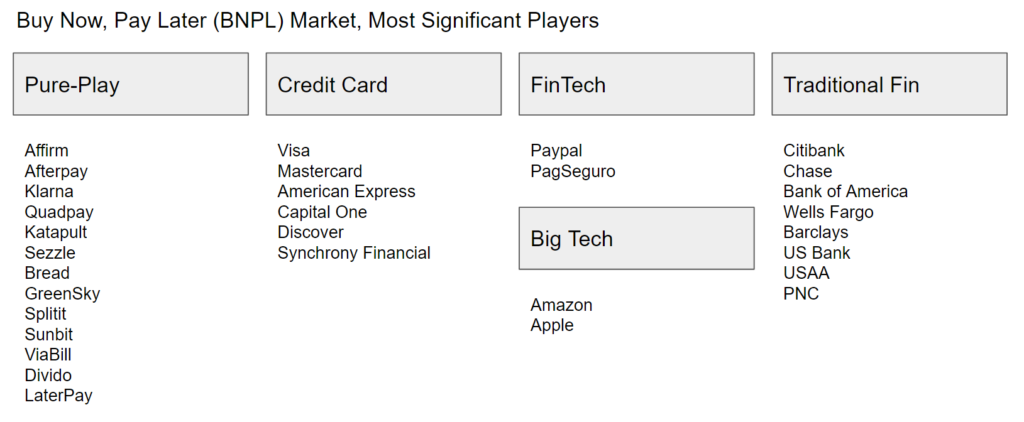

Buy Now, Pay Later Players

Pure-Play Highlight

Affirm (AFRM, $15b mkt cap)

As a grounding, there are probably three key items to call out about Affirm: insane GMV growth, key clients, and new product innovation. The company has gone from barely visible in 2015 to $4.6B in 2020 (77% growth yoy v 2019). Affirm has risen with its key client signings. Peloton to this day represents ~28% of its revenue, their second huge client (after Casper in 2014) back in 2015. Signing Expedia in 2016, Dyson in 2017, Walmart in 2018, and Shopify in 2021 have been critical growth drivers. Levchin, the ex-Paypal Mafia founder, dreams of providing car and home loans through the platform, one day. The company’s overall positioning to do what is right for consumers, such as no late fees, seems to have resonated and help it expand.

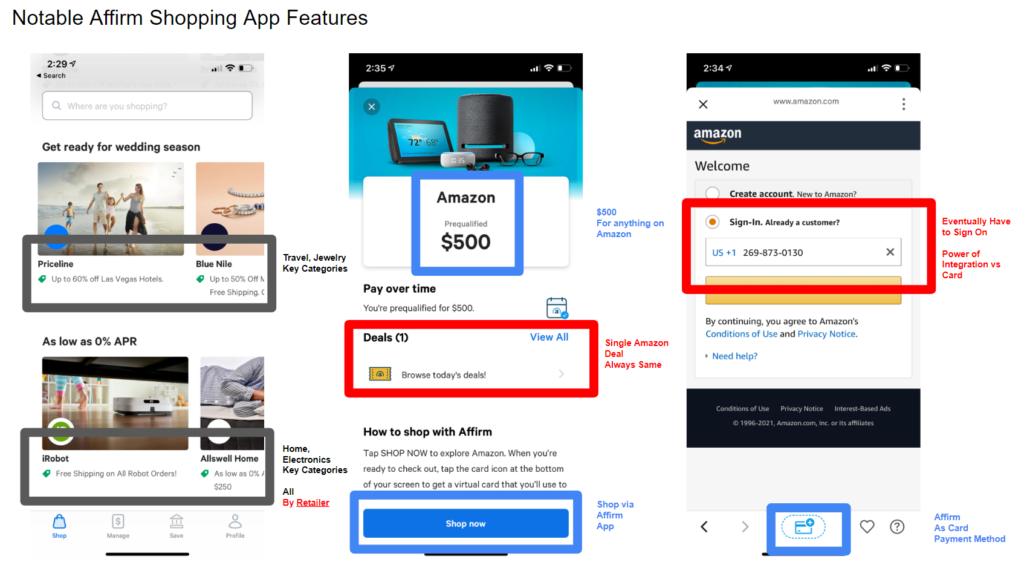

Product vertical wise, the company has expanded to include virtual cards, split pay, savings, and marketplace. The marketplace is perhaps the most significant of those decisions. Like Shopify, who it’s partnered with, Affirm has launched a user-facing shopping app. The app allows Affirm to build an ongoing relationship with consumers and feature shopping options with retailers who do not prominently feature Affirm in their checkout. For instance, Amazon is one of the retailers Affirm tends to focus on, given its wide selection. Although the app has room for UX improvement, it attempts to overcome sign-in fraction with payment method creation via Affirm.

One final key element to call out for any marketplace business is the contribution margin. After all, GMV at a 30% rate (eg Apple, Google, Alibaba) vs a 13% rate (eg, Amazon) vs a 1% rate (eg PinDuoDuo) or a negative rate (eg early Uber) means completely different things. Affirm is somewhere between Amazon and PinDuoDuo, and, perhaps most importantly, improving. 2019 FY contribution profit of 2.5% increased 56% to 3.9% in 2020. This is much higher than competitor Afterpay (who has higher GMV, global footprint, and market cap; perhaps the subject of a future blog post.)

Super FinTech: Looming Threat (& Opportunity)

The digital wallet opportunity will be nearly $800b by 2024, and the two leading consumer finance apps in the US, Venmo and Cash App, are unlikely to be left out of the BNPL space in an attempt to reach the $100+/ MAU valuations.

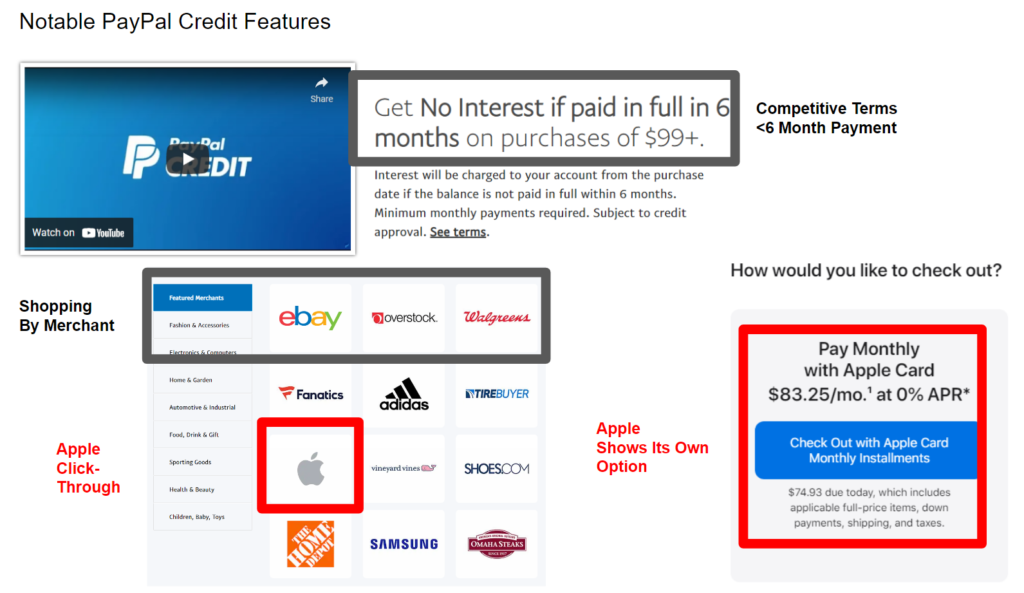

Paypal (PYPL, $297b Mkt Cap)

PayPal is already operating squarely in the credit space. They have mentioned it 12 times in recent investor days

Square (SQ, $106B Mkt Cap)

Square has one of the most unique networks, in that it operates with many more merchants than the typically e-commerce focused players, thanks to its ubiquitous square terminals. Today, the cash app has no featuring of a shopping or BNPL feature, but one could imagine one coming soon. Square is already issuing credit to merchants and issuing to consumers would be a natural extension. They represent a future potential disruptor for the BNPL pure players.

Needs Solved by Buy Now, Pay Later

Consumers

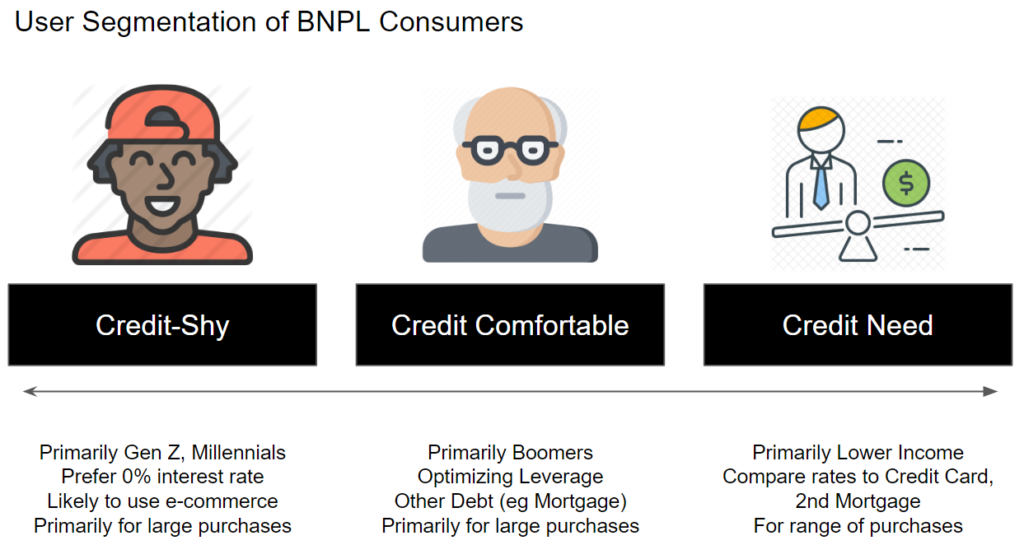

Buy now, pay later is particularly a hit with millennials and Gen Z consumers. 33% of 30-39 year olds, for instance, have used BNPL. One of the most interesting innovation areas is younger consumers who would otherwise not want credit or are considered ‘credit-shy.’ BNPL is, like Apple with the iPhone purchase plan, encouraging these younger, credit-shy consumers to take on loans that appear interest free. These are, for example, many of Affirm’s peloton customers. They want the bike, and the convenient interest-free payment plan is a plus.

But these are not the only consumers who use BNPL. In surveys, 63% of online shoppers, and 56% of Americans, had used the BNPL option to purchase something. Those who are not credit shy can be described as in two different buckets. One of them has a ‘credit need.’ Indeed, the second largest reason consumers use BNPL is to make purchase that otherwise would not fit their budget (38%).

The other is more ‘credit comfortable.’ They likely have a mortgage and are familiar with, and comfortable with, loans for items like their cars, and are okay to do so with other large purchases as well.

Generally, consumers tend to like these for certain categories. Electronics has been the leading category, at 44%, followed by clothing and fashion at 37%, furniture and appliances at 33%, and household essentials at 31%. These are all generally large purchases, and tend to be the focus of the credit-shy and credit comfortable. But groceries are also 23%, and books, movies music, and games at 15%. Credit need consumers often buy these products using BNPL.

Merchants

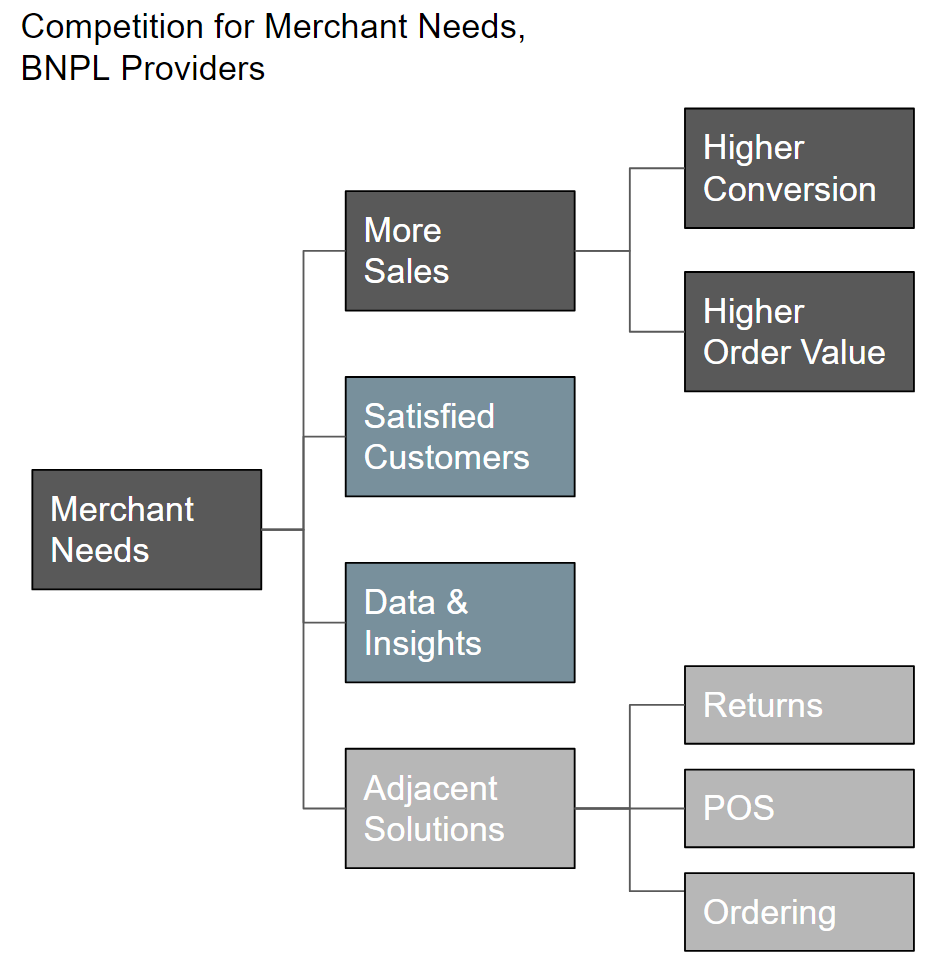

Merchants primarily want more sales. Buy now, pay later helps them in two key ways: higher conversion, and higher order values (others include up-front and in-full payments, larger customer base, and repeat purchases). This business case is transparent and clear for businesses – as long as customers are satisfied. Growth oriented product managers, and their companies, are willing to pay great sums for lower add to cart abandon rates. Providers have also tried to compete with ancillary benefits for merchants including data & insights, and adjacent solutions like returns (eg Affirm), POS (eg Square), and ordering.

This value has translated to larger average service fees. Afterpay, at ~3.9%, is much more than Visa & Mastercard Debit at ~0.5%, Visa & Mastercard Credit at ~0.9%, American Express at ~1.5%, and Paypal at ~2.8%.

Future of BNPL

While 0 earnings calls mentioned Buy Now, Pay Later in April 2020, 46 did in February 2021. The revenue charts of pure-play players are classic exponential growth. The market is here to stay but one of the most interesting questions is will one of the retailers, big techs, fintechs, or traditional finance players actually come to dominate the market?

When I purchased my iRobot this year, I used Amazon’s payments plan. What is stopping Peloton from doing the same one day, taking away the need for Affirm? As the winds in FinTech continue to blow towards all-in-one digital banks, the market is still wide open. Data, networks, and consistent product innovation will determine the market. The key players will need to innovate on both consumer and merchant needs. I think one thing is for certain, BNPL will continue to be a huge part of the market, and a key component for the Super FinTech apps of the future compete on. Will one of the BNPL players be able to leverage that advantage to win the war?

What do you think: which product teams will solve which persona’s problems & take the prize from the $8T Credit Card market?