Key Takeaways:

- Despite skepticism from industry insiders, esports is a highly investable mega-trend due to: the rise of streaming, school support, Olympic potential, the rise of women E-athletes, and the transition to casual & mobile

- As few public pureplay esports companies are on the market now, one of the best ways to play the space is the NERD ETF

- Many of the most exciting esports companies (eg, Mobile Premier League) are still private, only accessible to the accredited investor class as LPs to angels or VC funds like Bitkraft

One of the hottest investment topics lately has been esports. Surprisingly, I typically encounter more excitement outside the industry than in. I find it more likely for gaming industry insiders to be pessimistic on the future monetization opportunities of esports than outsiders. So, who is right? Buckle up for a deep dive into the space from an investment angle.

Trends Supporting Esports

Rise in Streaming

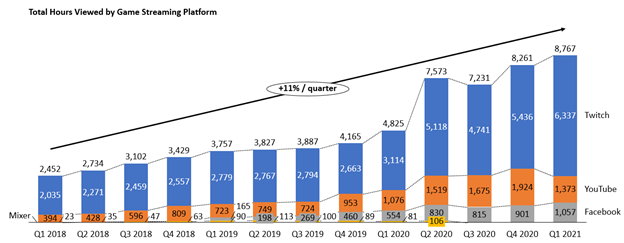

The game streaming websites of the west – Twitch, Youtube, and Facebook – have been growing like weeds. Since Q1 2018, they have been growing at a compounded 11% per quarter (53% CAGR per year).

And there are not just the western streamers. Bilibili, Huya, and Douyu (China), as well as Afreeca TV (Korea), are giant international streaming companies with a strong focus on gaming. Esports are regularly amongst the most viewed on game streaming websites. Games like League of Legends and Call of Duty see huge spikes in viewership come competition time.

The total audience is expected to grow at a 7.7% rate in the coming years. This year it is already nearly half a billion strong, 474M according to Newzoo.

School Support

Esports are ramping up in college and high school. Nearly 200 colleges and universities in the US and Canada alone are actively recruiting for esports scholarships. And there are over 170 varsity esports programs. It’s no wonder when the NCAA Final Four maxed out at 28M viewers while Riot’s Mid-season invitational event for League of Legends had 60M. With revenue down, colleges will be looking to esports for monetization opportunities. The NCAA is nothing if not a machine attracted to cash.

This is a market in its absolute nascency. While 2020 saw about 1.6 billion total esports hours watched, the collegiate ecosystem had 1.5 million total hours watched in 2020. CSL Esports led the pack with 196 thousand hours watched.

Spotlight: PlayVS

One of the up-and-coming companies leading this charge is PlayVS. PlayVS had 19 thousand hours watched in 2020. The company has signed an exclusive contract with the National Federation of State High School Associations to build infrastructure for state level esports championships. They have high school seasons around 5 games including League of Legends, Madden NFL 21, and FIFA 21. These are varsity letter sports with a coach. They also have college seasons around 5 games including Madden NFL 21, FIFA 21, and Overwatch. With $106M in VC backing, the company is set to continue to grow the market for esports in education for years to come.

Olympic Potential

Esports look set for inevitable Olympic inclusion one day. Although, it took the Olympics several decades before introducing rock climbing (an actual physical sport), the question in the minds of many insiders these days is, “if not when.” The Olympics have been dropping in ratings, the average age of viewers is rising rapidly, and the audiences are becoming worth less to advertisers.

Rise of Women E-Athletes

Women have already been making waves in the gaming space, one of the largest consumers of both serious young games like Roblox and casual older games like Candy Crush. The market for women’s gaming is growing much faster than men’s gaming.

The same trend is likely to continue with esports. For instance, Cloud9 made waves in October by becoming the first organization to create an all-women’s esports team for Riot’s competitive shooter Valorant. This was not just a token affirmative action team: the team has won a serious $25K competition.

Mobile & Casual

Esports used to be the realm of the most serious games. But with companies like Skillz creating platforms for casual games, there has been a big move into other gaming types.

Mobile esports also enjoyed a tremendous spike in 2020, with countries like India where the gaming market is larger on mobile devices. There are tons of companies – Mobile Premier League, WinZO, and more – focused in on mobile.

Revenue Sources

Dominated by Sponsorship

I consider Newzoo to have the most rigorous public esports market sizing estimates. They estimate the 2021 market is expected to cross $1bn, with a 14.5% year over year growth. Like traditional sports, a big chunk of this is expected to come from sponsorship (59%) and media rights (18%). While covid put a kabosh on ticket sales for in person events, the industry was overall highly resilient.

Poised for Growth

Although the market contracted about 1% in 2020 due to Covid, the market is set for ~11% yearly growth through 2024. Streaming is just one driver – right now it is a small portion at 2% of the total market but is expected to grow 26% in 2021. Publisher Fees will also continue to be a driver, expected to grow at 23% this year.

Betting

Wagering on esports is estimated to have exceeded $12 billion in 2020. In other words, the betting market is roughly ~12x as big as the rest of the market. This is an area that is ripe for monetization and I expect many players to expand into this area.

Top Games by Official Prizing

This is hardly an exhaustive list, but certain games are more engaged in Esports than others so far. (Estimated total 2020 prize pool in parentheses)

- MOBA

- DOTA 2 ($35M)

- League of Legends ($9M)

- Shooter

- Counter Strike: Global Offensive ($20M)

- Call of Duty ($6M)

- PUBG Mobile ($5M)

- Overwatch ($5M)

- Rainbow 6 Siege ($3M)

- Card

- Hearthstone ($4M)

- Sports

- NBA 2K ($1.4M)

The Esports Investing Landscape

Public Companies

There are at least 112 public companies operating with at least some exposure to esports. Gaming is one of the most global technology industries, and many of the most exciting opportunities exist outside American securities. Asian and European exchanges are where some of the hottest companies are listed. Very few of these companies are pureplay esports, however. They tend to be gaming companies with some interest in esports.

Take Twitch, perhaps one of the most exciting streaming investments in esports; it is buried inside Amazon. Similarly, on the peripheral side, Astro is inside of Logitech. But there are a few pure plays.

Spotlight: Modern Times Group

Listed in Sweden, Modern Times Group is likely the most pureplay esports investment available globally to investors today. It owns ESL, the world’s largest esports company, and recently also took in DreamHack under its umbrella, the second biggest company. The company has a <$2bn USD market cap.

Spotlight: Enthusiast Gaming

Enthusiast Gaming is a Canadian digital media company listed on the NASDAQ (if your brokerage does not have Swedish shares, eg, perhaps more accessible.) It has over 300M gamers visiting its sites monthly. It has 100 websites, youtube channels with 24M+ subscribers, and owns several teams including Luminosity gaming and franchises in Call of Duty and Overwatch leagues.

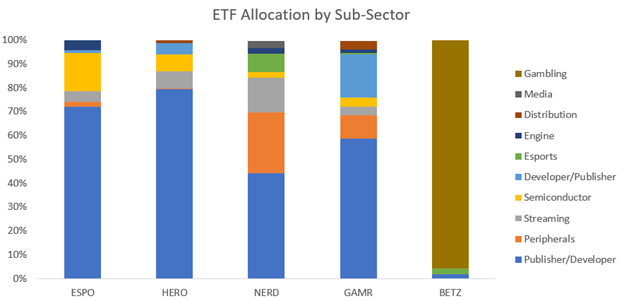

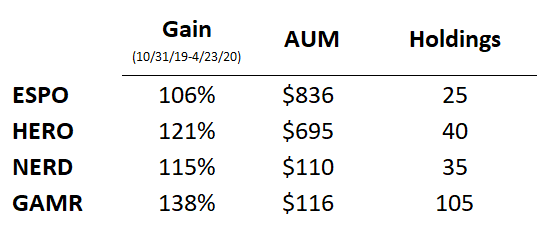

Breaking Down Investing Vehicles

Five ETFs are now on the market with some claim to esports exposure: ESPO ($836M AUM), HERO ($695M AUM), BETZ ($499M AUM), GAMR ($116M AUM) and NERD ($110M AUM). ESPO and HERO are more akin to traditional video gaming plays with highly concentrated portfolios (25 and 40 holdings respectively). BETZ is a hybrid with exposure to digital betting and iGaming, really the adjacent components to esports outside of video gaming. GAMR is the broadest portfolio, with all sorts of video game technology (105 holdings). NERD is the closest to a pureplay investment.

Modern Times Group, one of the most pureplay public opportunities, only shows up in NERD and GAMR’s portfolios. In GAMR, it is 0.27%; on the other hand, it is one of NERD’s largest holdings at 5.54%. A critical component of the esports investment opportunity is peripherals. Only GAMR and NERD have the pure plays Razer and Corsair. And only NERD has Logitech. Another component of the esports investment opportunity is media. Only NERD contains Enthusiast Gaming.

On the other hand, it is easy to argue that companies like Google and Microsoft are players in this ecosystem. Google, with Stadia, Google Cloud, and the play store, is the home to some of the biggest games on the planet. Similarly, Microsoft, with its Xbox division, is a key player in the gaming industry. But these companies’ relative gaming exposure is small. If you want to include companies like these, and shy away from the pure plays, then GAMR is an alternative, as the only ETF holding those names.

All four gaming-centric ETFs have done well (they all have benefited from the meteoric growth in Sea). GAMR, by including all the small caps that the other ETFs do not focus on, has had the best performance in the period where they are all comparable. It also seems to be faster to move to important names like Roblox, the only ETF owning it as of today. Despite its low AUM, NERD has had respectable performance as well, gaining 115% in about a year and half.

Private Companies

Despite the number of public gaming companies, some of the most exciting pure plays in esports are still private. 2020 saw at least $390M in investing in the space. And this year has kicked off with some gigantic rounds from some of the most exciting names in the space.

Spotlight: Mobile Premier League

MPL is one of the fastest growing and most disruptive players in Esports. Between September 2020 and February 2021, MPL managed to double its valuation to right below unicorn status at $945 million.

The app is a gaming platform which hosts about 70 games, 60 million users in India, and 3.5 million users in Indonesia. Like other platforms like this in India (eg WinZO), the app also has a section focused on India’s rapidly growing fantasy market.

Spotlight: VSPN

VSPN is one of the hottest players in China’s rapidly growing esports market. The company raised a massive $100M series B and has over 1000 employees.

Like many of the private players, VSPN’s primary business is esports tournament organization, but it also does a lot of content creation and is recently expanding into offline venue operation. Offline esports competition are the premiere because on a local area network, no player gets a competitive advantage from lower ping.

Investors

With the private investment as hot as it has been, many VCs have found themselves invested in some esports companies. There are also a few pure play gaming focused investors if you are lucky enough to be LP-sized:

- Play Ventures

- BITKRAFT

- Sisu Game Ventures

- Makers Fund

- GamerForce Ventures

- Artist Capital ($100M esports fund)

- GameFounders

Individual partners, like Rick Yang, at larger firms like NEA, are also known fans of esports. Visible and Signal have interesting information on other key partners, and Manny Anekal has written up esports investments from the bigger firms. But none of these VCs are close to as pureplay as NERD. They invest in the whole gaming industry.

How to get in

At this point, one of the best ways to get access to the hottest companies in the space, which are private, is to go work at one of them or checkout secondary markets like Shares post. If you are an accredited investor, you could also consider angel investing. There are relatively few other good options for such a nascent market.

Risks

So, are all those industry insiders wrong? Not quite. There are legitimate risks to investing in esports now.

Market vs Investment

The Esports market is still, amongst investable markets, tiny. The total gaming market in 2020 was ~$175B. At ~$947M, esports represent a miniscule 0.5% of the total size of the gaming market. On the other hand, investment in the space has been red hot, with at least $168M so far in 2021. In other words, VCs poured ~16% of the entire market size investing into companies already this year. The market is red hot, and prices / enterprise values are sky high compared to revenue.

Views vs Revenue

Right now, esports is generating much more impressive viewership figures than revenue. Esports have been around since 1980 and this problem has yet to be solved. It is possible that esports never monetizes like traditional sports. It could become a policy debate activity – loved by those who participate but watched and monetized by few outside of it. The average League of Legends game for a non-player, for instance, can be hard to appreciate.

Summary

I do not think esports is close to a fad. The trends support a rapid growth of the market in coming years. All the cool companies I have spotlighted in this post have made me hopeful that the key risks will be overcome by clever entrepreneurs. Esports is an investable mega-trend.

What do you think? Any errors or misjudgment on my part? Feel free to chime in, in the comment section.

Additional Learning

Articles

- Goldman Sachs: eSports: From Wild West to Mainstream

- Newzoo: 2021 Free Global Esports Market Report

- Stream Hatchet: State of Collegiate Esports

- Carl Niedbala: Venture Capital in Esports

Publications

- The Esports Observer: Market and Companies

- Dexerto: Esports

Podcast

- The Acquirer’s Multiple: More People Watch Gaming And Esports, Than Netflix, HBO, ESPN And Hulu Combined

Bonus: The Gaming Stadium is an esports venue publicly listed in Canada.

One reply on “Esports: Fad or Investable Mega-Trend?”

[…] MPL followed that announcement in November, that it was sponsoring the Indian cricket team’s uniforms and kits. These massive marketing efforts in the country’s most popular sport have furthered the reach of gaming. […]