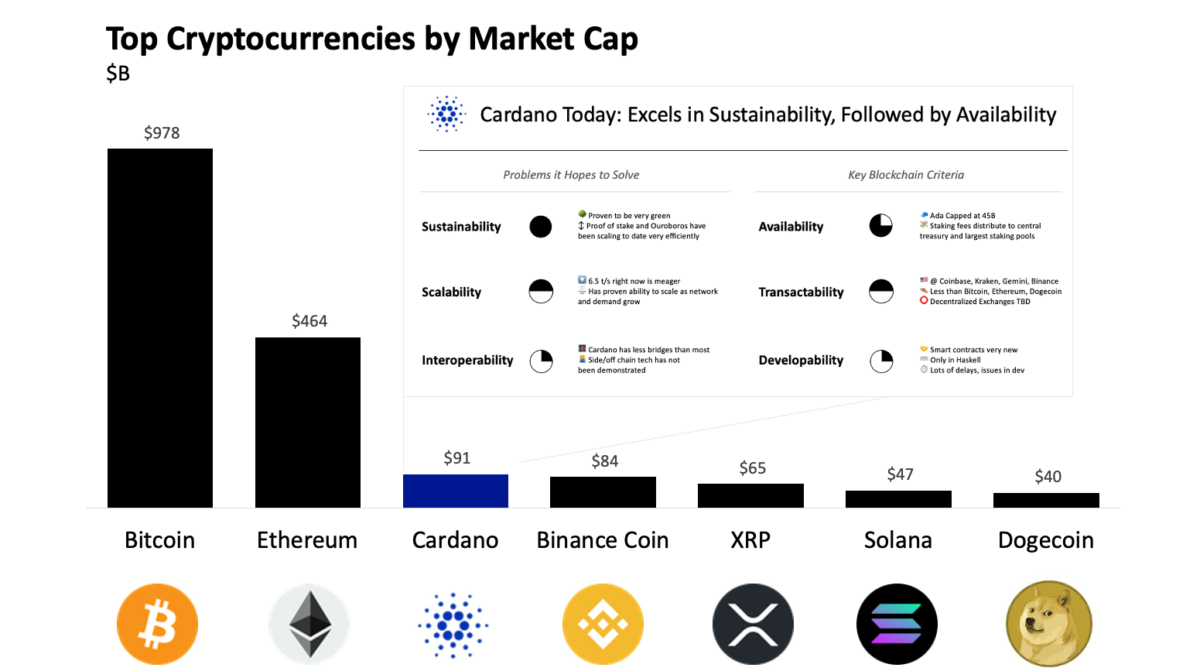

Aug 21, 2021 💭 “Cardano… the altcoin I invested in back in 2017?” I was really surprised to see the headline that Cardano had become the #3 cryptocurrency a few weeks ago. That makes it the leading crypto behind Bitcoin and Ethereum. It is amazing something became so big with me knowing so little. As […]