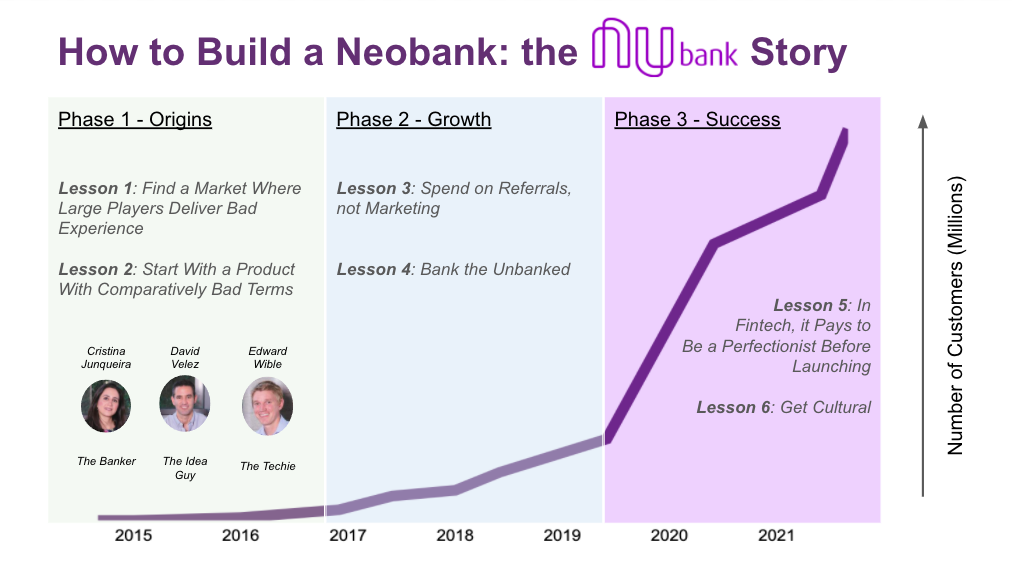

Nubank is one of the buzziest FinTechs around. Over the last three years, it grew from 3.7 million customers to 48.1 million customers. That’s a 100% CAGR in new customer additions. It looks like your typical exponential hockey stick:

For size perspective, Bank of America only has 40.0 million digital active users of its consumer banking services. Nubank has more digital customers than BofA. It is now the largest neobank in the world.

But how did NuBank become the world’s largest neobank? What lessons can builders, fintech analysts, and product leaders take from its story? As the company is about to IPO, let us learn more about how to build a neobank.

Phase 1 – Origins

This story starts, like so many tech giants, with a Stanford graduate.

After growing up in drug-torn Medellin, Colombia, David Velez’s family escaped to Costa Rica when David was 9. There, he studied in German-language prep school and graduated as valedictorian, earning him a trip to Stanford for his undergraduate studies. After completing an engineering degree and a few years in banking and private equity, he returned to Stanford for his MBA.

Upon graduating, he headed to Brazil to build out the Venture Capital firm Sequoia’s to Latin American business. It was the perfect next step for the budding technologist. Or so David thought. Mere months after relocating to Latin America’s largest economy, Brazil, Sequoia pulled the plug on the Latin American experiment.

It turned out to be a good learning experience for the entrepreneur nonetheless. David got to intimately learn the structure of industry in Brazil. And he had one great realization:

What’s the biggest industry in Brazil? Banking. And what’s the most profitable banking?

After years of inflation, interest rates were high. Being a bank was a highly profitable enterprise. Not only was banking the biggest and most lucrative industry in Brazil, it was also highly concentrated. 5 banks controlled 82% of the market. As a result, the customer experience was horrible.

David experienced this subpar user experience first-hand. When he moved to the country, it took weeks of waiting in-person, and filling out myriad forms, to do basic financial activities. It was a far cry from the US, or even his native Colombia, or childhood home Costa Rica. It was actually terrifying:

I remember getting locked in those bulletproof doors a couple of times because I had my cell phone in my pocket and guards looking at me with guns

This is the first lesson from NuBank’s story:

Lesson 1: Find a Market Where Large Players Deliver Bad Experience

Of course, if you find such a market, there will be reasons. The existing locals will have been too shy to build a business. They can see all the structural barriers that the market dominating incumbents have put up, and it scares them. David was undeterred. As he says:

Nubank could never have been started by a local… It required a Silicon Valley investor who has seen this story of the tiny ant going against the elephant and succeeding. A Latin American investor sees that and says, ‘No way, the elephant is going to crush you.’

The digital transformation that was sweeping Brazil in the early 2010s was clear for anyone to see. But only David seized the opportunity to create a company.

He began the process of working on a neobank in Brazil. He connected with industry insiders. He networked with other upstarts like Capital One in the US and ING in Europe. He learned the trade secrets. Armed with this information, he formed the initial Nubank strategy: they would offer credit cards that beat the big banks on fees and convenience.

After raising a $2M seed round, Sequoia partner Roelof Botha convinced David to find co-founders. In searching, David met Cristina Junqueira. An engineer with an MBA from Northwestern who had been heading up one of the big 5 Brazilian bank’s credit card division. She was the perfect fit to navigate the Brazilian market.

To enhance the tech bonafides of the business, David turned to a contact from his Sequoia days. He had met Edward Wible, a Princeton Computer Science grad with an MBA from INSEAD. The three co-founders would make the ideal trifecta to conquer the Brazilian banking landscape.

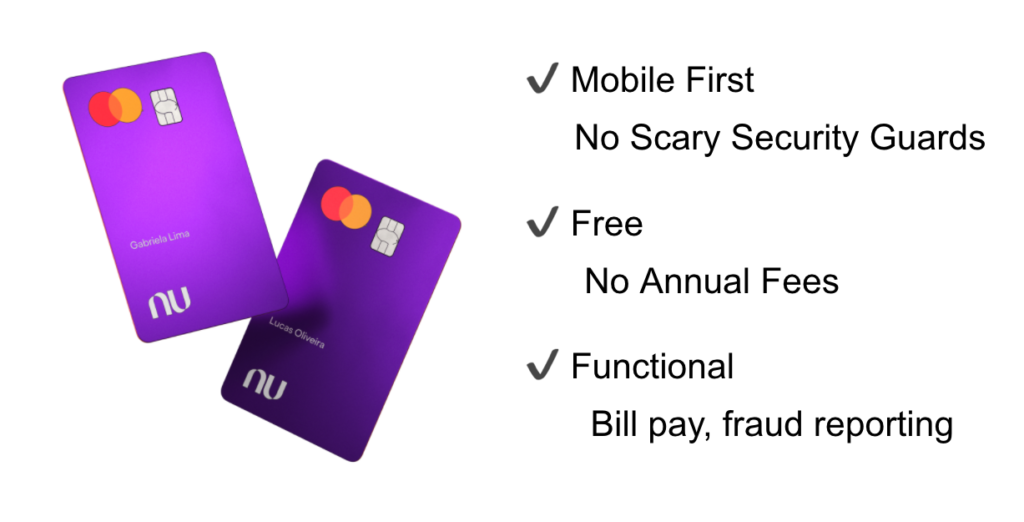

The trio rented a house in Sao Paulo and got to work. In August, 2014, they raised a $15M series A. They launched Nubank’s beta a month later, with the primary value proposition being credit card with no annual fees. It did not need a banking license to launch a credit card. To this day, that is its largest revenue driver, the interchange and interest fees from its credit card business. It was a case of prescient instincts from the start. The existing products were horrific. Brazilian credit cards had interests running 200% to 400% a year.

On top of that, they charged annual fees. The lowest competition was $20. Nubank was free. That is the second lesson from the Nubank story:

Lesson 2: Start With a Product With Comparatively Bad Terms

In addition to having better terms, Nubank provided a better user experience. In contrast to the crazy lines and terrifying guards David had experienced banking at a traditional player, Nubank was fully through the app. Suddenly, using a credit card was simple.

Phase 2 – Growth

It was both a revolution in simplification and functionality. Features like requests to bill pay and fraud reports become accessible by the click of a button to millions of Brazilians who had never dreamt of going into a bank to use such a feature. Credit card decisioning usually took less than 2 minutes. This substantially increased the attractiveness of credit cards. As a result, the company grew like a weed.

To summarize how the company has lived out this lesson to this day is “obsession with the customer.” Nubank thinks like a product company and puts user problems first. Here’s how David describes it:

There are a number of different things that we’re doing differently. But I would say the number one is having a culture that is obsessed about customers and doing the right thing for the customers, from doing the right decisions, to giving the right customer service, to building products that are really actually good for them. I would say that’s number one.

This obsession with the customer mirrors all the best tech companies, from Stripe and Paypal to Google and Amazon. To grow their customer base, Nubank avoided spending its $15M on marketing dollars. Instead, they established the company’s purpose to fight complexity and empower people with their finances. For such a mission, they employed a different, yet tried and true fintech acquisition channel: referrals.

Lesson 3: Spend on Referrals, not Marketing

Where Paypal started the referrals trend on the web, Nubank started it on mobile in Brazil. Built prominently into the app, the engine worked from the start for the company. A year and four months after launch, the company had 350,000 credit card clients.

Why did referrals work so well for Nubank? The product had great fit for the users it was looking to target. Free is hard to beat. Every other credit card on the market at the time had an annual fee, and took ages to sign up. There are four drivers of a successful referral channel: social being core to the product, historically high interest, the product being free, and the channel being novel to your users. Nubank succeeded with three of the four:

It’s not like Nubank was operating in an easy market. In 2015, HSBC sold their retail operations and left the country. In 2016, Citigroup followed.

From that start, and to this day, the company acquires 80-90% of its clients from organic channels. As a result, blended customer acquisition cost (CAC) has been less than $5 USD per customer.

In this way, Nubank replicated the Robinhood effect in the US – offer a product that’s built for mobile, free when nothing else is, and has a much better user experience to a new group of users. Indeed, Nubank obsessively focuses on a very specific customer at that, which is lesson 4 from its story:

Lesson 4: Bank the Unbanked

When Banking expert Thais Carnio investigated Nubank he came out finding:

They have opened up more possibilities for middle- and lower-middle-class consumers, as well as an economically promising young demographic

From the start, the company has helped people who couldn’t afford an annual fee try out a credit card. This proves out in the usage data. Users start out with about 4 transactions per month, but over time that increases to 18-20 per month. Users have to warm up to credit card usage.

The unbanked generally find digital banks attractive because of their ease of use and mobile nature. And digital banks have done very well in Brazil recently. Nubank has seen the rise of highly funded rivals like Co Bank and C6.

Phase 3 – Success

In 2017, about 33% of Brazil was unbanked. As a result of the rise of neobanks of forces of Covid-19, in under four years, that number has reduced 10% – so 30% remains unbanked. That is still over 60M unbanked. Brazil has a higher proportion of unbanked than Russia (24%), India (20%), and China (20%):

The pandemic, in particular, was a huge boon for digital banking. Studies estimate 17 million Brazilians opened bank accounts. That has contributed to Nubank having helped 5.1 million open their first credit card or bank account, as of its F-1 filing.

Overall, the company has continued to just pursue this strategy for the most part: help the unbanked. It starts them with credit cards. Nubank has actually been relatively slow to add new products. Now, Nubank offers debit cards, bank accounts, loans, and life insurance. But it was not always that way. This is the fifth lesson from the Nubank story:

Lesson 5: In Fintech, it Pays to Be a Perfectionist Before Launching

Nubank has taken a measured approach to product launches:

These products help Nubank increase the lifetime value of its customers. It acquires them with relatively low LTVs upfront, because the credit card has no fees. As a result, this is a crucial part of the strategy.

The strategy worked phenomenally well over that time period. By 2019, Nubank had become the most valuable startup in Latin America. It was the largest bank outside of Asia. Tiger global invested. Nowadays, customers often start with three Nu products, and all cohorts are averaging three to four. Its last task is to break into the mainstream:

Lesson 6: Get Cultural

Already, 28% of Brazil’s population over 15 uses Nubank. The brand is as ubiquitous as Brazilian soccer star Neymar. But far more tune into Neymar’s games than Nubank’s products. To do that, it has to be more than known. It needs to make a cultural impact. Nubank is making this push in its home country and with investors.

In its home country, Nubank recently appointed a pop star to its board. They also used the star to help promote their investment products. This is the normal transition brands make to working with A-listers. She is helping them produce artistic, splashy TV ads:

It is also making a cultural push on the investor front. In its latest raise in June, Warren Buffet’s Berkshire Hathaway even invested. In the final step of becoming more culturally relevant, the company has put on a big show for its IPO. It has even included a retail allocation for Robinhood account holders.

In this latest round before Nubank’s IPO, it was valued at $30B. While originally news was it might go out for $50B, now that number looks more like $40B.

Whatever the valuation, the business is impressive. In addition to the hockey stick growth we talked about at the beginning, the company is expected to break even over 2021 and begin to turn a profit in 2021. This is based on the company’s strong customer economics, with customers continuing to pay off about 11 months after acquisition:

The company has room to continue to increase average revenue per active customer through product expansion. About half of Nu’s customers consider the bank their primary bank today. Over time, it can break into user’s main accounts to monetize the rest of their future lives. Its main obstacle will be the increasingly fierce competition:

Future – Can The Disrupter Avoid Disruption?

Early in its life, Nubank represented disruption against the big five banks in Brazil. Now Nubank is effectively the sixth, as part of the big six.

C6 is a particularly interesting challenger. Founded just in 2019, C6 already has 7 million clients just 2 years after founding. JPMorgan acquired a 40% stake in the company in June. Banco Inter is another digital challenger. With 6 million users in 2020, it has been making moves into a Superapp.

MercadoLibre is a competitor of different sorts. The company already has a strong presence across Latin America and its pago division does a good job focusing on businesses, where Nubank’s strength is consumers. In the most recent quarter, it grew Brazilian revenues 120% YoY. It could infringe on Nubank’s neobank features.

For Nubank to stay ahead, it will need to continue innovating.