The private $100B company is rewriting the product growth playbook

We are all at least 25% more interested in Stripe because we cannot get a peak under the hood. This has made for the stuff of several amazing profiles.

But, what exactly is its legendary product strategy? What lessons can product leaders take from Stripe? Enter this piece.

It all starts with day one.

Lesson 1: Make Something Your Customers Need to do Easy

2010

Like many great products before it, Stripe grew out of personal frustration. After selling his business for eBay power sellers, Patrick Collison was debating with his brother John why it was so difficult to accept payments on the web. The two “were really appalled” how hard it was with existing products on the market.

So they set out to build a better product. To kick-start the company, they raised a $20K round from Y Combinator. The brothers spent six months on a prototype to make accepting payments on the web dead simple for developers. They pioneered PayFac technology, which allowed developers to accept payments with a few lines of code, instead of going through a lengthy list of arduous tasks: payment gateway setup, credit card storage, PCI compliance, and bank management.

Two weeks after launch, they acquired their first customer. Patrick had offered to write the code to switch off PayPal checkout for another Y Combinator participant. From there, it was off to the races.

Product market fit was almost “instant.” Word spread like fire. It is amazing to hear Patrick describe how the virality surprised the young co-founders:

Initially it very much spread through a word of mouth process. That was surprising to us because it’s a payment system, not a social network, so it’s not something you’d think would have any virality whatsoever. But, it became clear that everything else was so bad, and so painful to work with, that people actually were selling this to their friends.

Few products spread this way. How exactly did Stripe? It made something customers needed to do easy. Developers have high standards, and they talk to one another. Stripe meeting those standards led to continued growth for Stripe. They replaced the lengthy enterprise sales cycle with a direct to user model. They turned exceptional customer experience into a marketing strategy.

This early on in its life, Stripe, for its core payments product had already locked on its key customer, persona, problem, and solution. “Stripe is a company built by developers, for developers,” as the saying goes.

This was not a straightforward choice. Historically, the CFO was the ultimate payments decision maker. Surely, some of Stripe’s early advisors would have advised against it, but Stripe stuck to its focused user persona. There is great power in focus. It allowed the product and engineering teams to build for that single persona, instead of everybody.

Lesson 2: Don’t Jump Into Big Marketing & Sales Spend

2011

Come time to raise money, Stripe put together a buzzy seed round. It was a “who’s who” of Silicon Valley investors, including Peter Thiel, Elon Musk, Sequoia Capital, Andreesen Horowitz, and SV Angel. Stripe raised at a $20M valuation.

The crazy thing? The company had done almost no marketing. When Michael Arrington at TechCrunch wrote about the raise, he did not know much about the product. He had to ask for the basics we all now know:

“How is it different than PayPal or Google Checkout?” I asked someone who’s seen the product. Their answer – “It doesn’t suck.”

Stripe focused on product development, so the product did not suck.

It is worth reflecting on the competitive pressure Stripe would have faced to scale sales and marketing. Braintree was founded in 2007, and in 2011 it already ranked 47th on Inc. Magazine’s list of the 500 fastest-growing companies. Braintree was building a similar product, for a similar market, with 2 years head start. After Stripe’s March raise of $20M, Braintree followed up in June with a raise of $34M.

This is one of the moments where companies define themselves. Instead of going the marketing/sales route, or the hybrid route, Stripe chose product growth as its strategy. According to Chief Financial Offier (CFO) and Chief Product Officer (CPO) William Gaybrick, the sales team was “diminutive,” and they only had 1 marketing person. Most SaaS companies establish a large outbound sales motion after raising at a $20M valuation. Not Stripe.

Lesson 3: Build for Platforms and Marketplaces

Much of the economic activity of the internet goes through platforms. Stripe’s original product was a better fit for single websites and merchants. So, Stripe built a new product for platforms.

In late 2011, Stripe launched its second product after Stripe Payments, Stripe Connect. Where Stripe’s Payments APIs are the easiest way for typical merchants to accept payments and move money globally, Stripe Connect is those APIs for platforms and marketplaces specifically.

Like Stripe’s first product, Payments, the Connect product was quick to establish product market fit. That is because Stripe did not just go to market haphazardly. It spent six months in production testing the product. It iterated from learnings, for example allowing customers to add optional fees, as well as adding donations in SubReddits.

Fast forward to today, and Connect is estimated to be one of Stripe’s biggest revenue drivers. Take Shopify, which has done about $80B in payment volume over the last twelve months. At a 2.5% take rate, and 38% gross margin for that segment, we can estimate Stripe received $1.2B in revenue from Shopify.

By building out payments for an e-commerce platform like Shopify, Stripe is able to access Shopify’s incredible growth. Part of the reason building for platforms and marketplaces works so well is a principle of Paul Graham’s:

A startup that helps people make money will make money itself.

Platforms help people make money. Stripe helps platforms. Shopify is not Stripe’s only big platform or marketplace customer. Stripe also has names like Lyft and WordPress on the list. Stripe grows as these customers grow. This is how Stripe accomplishes its mission of building out the infrastructural rails for the internet. If Lyft and WordPress are building out the roads, Stripe is supplying the cement.

2014

Lesson 4: Go Deep to Solve Problems Well

In 2014, Stripe became a unicorn. Many companies celebrate the opportunity by expanding their product offerings. Not Stripe.

Between Payments and Connect, Stripe could service most types of internet businesses’ core payment needs (it would add subscriptions later). So, for years, Stripe focused on these two products, instead of solving additional problems. It went deep, instead of getting distracted by new products.

How do you help your teams go deep? Stripe had four main techniques.

First and foremost, Stripe did this by going deep on its customers. To this effect, there is a great anecdote in The Generalist’s profile about Patrick in the early days:

[A]t any given time, especially when we were smaller, [Patrick] could ask about a particular deal you were working on, and he knew about that company and how they should be using Stripe…[H]e took the time to actually be plugged into the technology and the products and the business.

It takes a willingness to get your hands dirty to start examining each and every customer’s implementation of your product. Stripe does this all the way to the CEO level. Members of their product team have described user research as part of the job of “every team across Stripe,” because it is “a part of literally every part of product development.”

Stripe also went deep by taking on complexity. Stripe continued to add on complexity in the back end of these products, like ML, countries, currencies. But at the same time, it continued to keep it dead simple for the developer once it reached them. All APIs, for instance, are backwards compatible. No new push will make old code stop working. This manifests itself in a design principle. As former Stripe employee Brie Wolfson put it:

Good API’s make things easier by providing a layer of abstraction between complex systems

Another technique Stripe used to go deep is adding scale. At the Stripe keynote in June, it shared that in the last 12 months it had 99.999% uptime over Black Friday and Cyber Monday. For a company that handled 173 billion API requests in a year, that is phenomenal uptime.

Finally, Stripe went deep by moving fast. Being deep does not mean moving slowly. Actually, Stripe is explicitly focused on speed. As John Collison explains, “speed is of the essence, and a defensible trait in companies.” Stripe publishes updates to its core API 16 times per day. That is far faster than most companies.

How do product leaders help their organizations go deep? Stripe uses vision, strategy, and principles.

Instead of playing zero-sum games, Stripe formalized its mission to, “increase the GDP of the internet.” This is the product vision. The strategy is to build economic infrastructure for the internet. Stripe’s product leadership further adds context to this with its operating principles. As CTO David Singleton describes them:

1. Put users first

2. Spend time to make it good

3. Design your organization

This set of context provides a path for the product teams to go deep for years. We can put it all together:

Lesson 5: Start With Startups, Move Upmarket, then Build for Everyone

In a way, Stripe is a great anti-incumbency platform. Large companies with thousands of engineers can build payments infrastructure themselves. They may even benefit from using their own proprietary signal in other arenas outside of payments in their ML models. But Stripe is building for those who do not want to focus on payments, and most startups did not. Stripe got into startups early and grew with them.

Over time, Stripe using startups did quite well, making a lot of noise about their use of Stripe. Stripe began selling to bigger and bigger clients. Stripe found that old world businesses like Harris Teeter and LVMH (the luxury brand worth $400B) “increasingly see they need the same technology that helps startups move so quickly.” Overall, Stripe made the normal disruption jaunt from startups to enterprises.

But it did not end at the typical jaunt for Stripe. Patrick Collison calls the normal cycle upmarket “the software cycle of life.” It has a big problem. As the products move upmarket to the enterprise, they become long in the tooth. Eventually, they become the ones that are disrupted. So, to avoid this fate, Stripe’s solution is to have high standards that its single product serves the bottom and top of the market well:

Startups are some of the most demanding customers in the world. They do not put up with complexity or outdated technology. On the other hand, large and established companies care about things like being forward thinking, security, and privacy. This helps Stripe do well for both. So the key learning from Stripe is: start with startups, move upmarket, then build for everyone.

Other companies within Stripe’s market have tried a different approach. Checkout.com famously contrasts itself by focusing on the enterprise. Instead of Stripe’s million merchants, it has 1,200. But checkout.com has 13% of the company working in sales, vs Stripe’s 3%. So that is a more sales driven business to win those big accounts. Checkout.com is worth $5B. It is a different scale business than Stripe, worth 20x that.

Lesson 6: Launch New Products When the Time is Right

2015

Part A – Timing

Fast forward to 2015. Stripe had raised several more buzzy rounds, continuing the positive momentum. But the Collison brothers were not content with being the payments company.

At this time, Patrick Collison was a guest at Stanford’s Technology-enabled Blitzscaling class. Thanks to the beauty of the internet, we can use the video as a time capsule to transport to his thinking at the time. He mentions the paradox of growth – as companies get bigger, they often ship more slowly.

Stripe had not launched a product in over three years. The company spent its first five years focused mainly on payments for merchants and platforms. It had gone really deep. Patrick now felt the company slowing, and was ready to change that. Internally, the company began working on new products, focused on new user personas and solving new problems.

2016

By early 2016, Stripe was ready to launch their first truly different product. Stripe launched Atlas, a platform that makes it easy for entrepreneurs to incorporate their business and begin accepting payments on Stripe. The cost? $500. This is an example of Stripe heading further down the market to build for startups. With Atlas, Stripe is building for companies at the inception.

Atlas is now one of Stripe’s most important products. Over 20,000 companies have used Atlas to incorporate. Moreover, one in four of them did so because of Atlas. Any organization would be proud to have launched 3,750 companies. Stripe’s paid product did that. It only amounts to $10M in revenue over 5 years, small for a company of Stripe’s scale, but by catching companies at their birth, it sets Stripe up for an ongoing relationship.

Stripe can then sell them other products. Stripe followed up the launch of Atlas with the launch of Radar. Radar is a payments optimization projection that enables fraud teams with ML from the Stripe network for 2 centers per screened transaction. That is an example of moving further upmarket to bigger companies.

Adding adjacent products like Atlas or Radar is a powerful strategy. Fast forward to today, and 94% of enterprise customers use multiple Stripe products. One can imagine a customer starting with Atlas, going to payments, then adding Radar as they grow. This is an arc of using Stripe to grow. It allows Stripe to double the compounding: growth of the client with growth of the share of wallet.

The key to adding products is timing. Stripe waited 6 years from the original idea to really do so. By then, it had a valuation of $9B. That is still more valuable than Zynga, fiverr, nCino, or Duolingo are today.

Part B – Doing it Well

What is particularly notable about Stripe is that both Atlas, Radar, and future products succeeded out of the gate. How?

It starts with a process called “shaping.” Ken Norton uncovered the details in an interview with their team. As they explain:

Shaping is the process of creating a rough solution to a concrete user problem — it fills the space between the broad strategy and the detailed product specification, or the PRD. This process front loads a lot of the critical thinking about what you’re planning to build and why

This is an interesting document that Stripe builds to continue to manifest its product principle of putting the user first. The document is formed on the basis of a concrete user problem. Written from the perspective of the user, they even walk through the curl commands a customer would use.

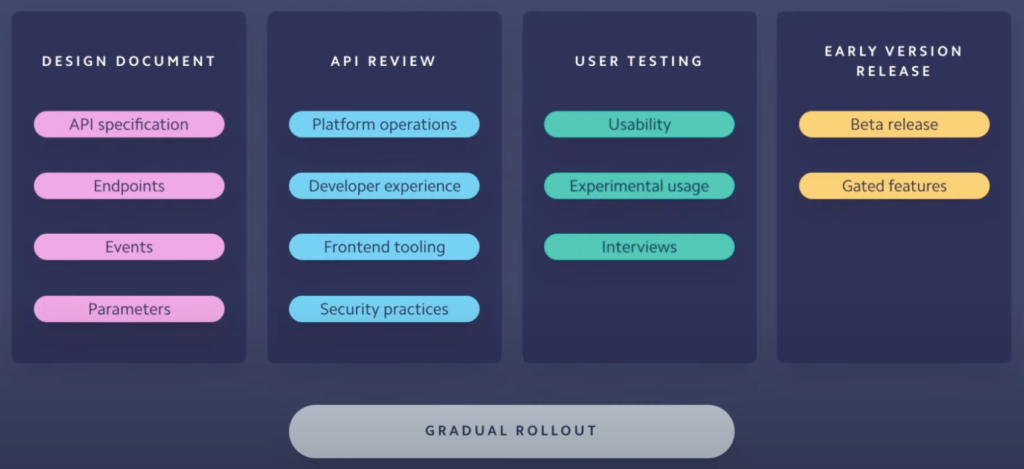

From there, Stripe gets feedback from internal experts and users early and often, with a gradual rollout. The CTO summarized the process recently with this diagram:

As the diagram emphasizes, Stripe’s API Design Process involves heavy feedback. There is an API review and user testing, as well as early version release. This allows the final version to click with product-market fit.

Lesson 7: Define a North Star

2018

As Stripe continued to launch myriads of new products, the company needed a north star. A framework for customers, product managers, and engineers to put around all the individual components. Stripe shared exactly that with its 2018 Conference Keynote. Stripe began calling itself a “Global Payments Treasury Network” (GPTN).

This is Stripe’s true north star, as the company has continued to emphasize. In developer speak, the GPTN is about becoming a TCP/IP for money. In layman’s speak, GPTN is about building programmable infrastructure for global money movement. Stripe does a whole lot beyond the GPTN, but that is the foundation for the business.

Stripe’s Chief Product Officer, William Graybrick, explains the north star eloquently in a recent interview. If there is one Stripe product video to watch, this is it. It is always good to catch a company’s product leader off script of a presentation. You get the essence of their thinking. In this case, William immediately redirects consistently to the north star:

In this interview, we learn that Stripe thinks about infrastructure by analogy from AWS. What are the two big things AWS brought online? Compute & Data. Stripe has been pursuing this “AWS Strategy:”

- Compute: Users building on Stripe want the ability to seamlessly move money around the world, with great authentication and fraud mitigation.

- Data: Users building on Stripe want to be able to put money in the cloud and hold balances in different currencies, with the ability to transmute it.

Defining these user jobs to be done clearly from the top is how William and Stripe’s product leadership keep the whole organization headed to the same north star: building the infrastructure of the GPTN. If “focus is everything,” as the saying goes, the north star helps to provide it.

Lesson 8: Go Offline to Enhance the Flywheel

In 2018, Stripe launched Stripe Terminal. Terminal is Stripe’s own version of Square’s iconic POS reader. It is a physical device to accept payments in the real world. This is a telling product launch for the company.

The company’s core is increasing the GDP of the internet, but it has built a product that is not for the internet. Stripe is willing to build other products. But Stripe is not simply trying to compete with Square by going after offline-only merchants. As the landing page for Terminal says: “Stripe Terminal helps our users extend their online presence to the physical world.” It is more about extending offline presence for their already technical clients. In fact, as one Stripe employee who used to work at Square said, Terminal is “not for an SMB coffee shop with no developers…You actually need to be a developer to use it.”

Terminal is part of Stripe’s relentless mission to help the GDP of the internet by helping its internet users succeed off the internet as well. Terminal helps Stripe’s customers unify their payment stack, grow overall platform revenue, and scale with greater ease. A job posting for Engineering Manager on the Terminal team explains that Terminal is designed for three use cases:

- Creating a superb retail experience

- Extending their website to a pop-up store

- Enabling a mobile point-of-sale at their next event

This creates a flywheel that we can make explicit:

Building products to help merchants offline helps them grow, which helps them buy more from Stripe. Take Stripe’s client, HomeCall Pro. They started using Stripe on their website. But after Stripe released Terminal, they integrated that product in their day to day operations of doing in-person house repairs. This increased Stripe’s share of wallet and simplified backend payments infrastructure for HomeCall Pro.

This flywheel works for many of Stripe’s customers. The strategy of going online is a common one in ecommerce. We see this with Warby Parker and Casper among the direct to consumer brands, as well as thredUP amongst the marketplaces. Offline stores can act as stationary billboards, enhancing online customer acquisition. The same logic applies for offline activities of Stripe’s millions of customers.

Lesson 9: Scale Geographically

2021

Fast forward to this year. In the Stripe Sessions Keynote, Stripe announced it has opened 11 new countries to the core payments products. Stripe is using geographical expansion as a growth lever. For any company, international expansion is a natural growth opportunity, by opening up new addressable market size.

But for a payments infrastructure company, international expansion has several unique benefits. First, it enables Stripe to receive more business from existing clients who were using different options in that country. Second, it enables Stripe clients who were not operating in that country to consider opening there. Third, it makes Stripe more attractive to potential customers, because of its larger coverage. Finally, it makes Stripe more attractive to users because it has a larger number of acceptable payment methods and banks. As a result, this lever has great product-lever fit for Stripe.

Stripe also uses the lever strategically. Atlas is Stripe’s market testing product. Atlas is available in 140 countries. Payments are available in only 44 countries. The Generalist called this Stripe’s, “advance guard for geographical expansion.” The strategy is to take a lower development product to market first, to test the size and interest.

Once Stripe has hit upon a market that makes sense, it does not shy away from organic investment. It is always willing to make inorganic growth moves. Take the case of Paystack:

In 2015, Paystack set out to be Stripe of Africa. Now, it’s also Stripe’s biggest acquisition ever, at over $200M+. Since the acquisition, Patrick Collison said the team has been on an absolute tear. It is believed that it is processing more than 1/2 of online transactions in Nigeria. 🤯 Opening up great market share in places like Nigeria helps Stripe build the economic infrastructure for the internet.

Present

Is Stripe Still a Product Rocket 🚀 ?

It is common to say that Stripe has ramped up its sales & marketing engine. But just how much? Is it still a product company? In the product rockets framework for public companies, we look at the ratio of product development : sales & marketing expense.

We unfortunately cannot do that for private companies. But what we can look at is the percentage of employees on LinkedIn who are in sales and marketing. For this metric, Strip looks similar to another product rocket, PayPal:

If you double click further , Stripe is actually the lowest of the four companies for percent of employees in sales specifically. Its headcount is tilted more towards marketing. And this isn’t paid marketing. Packy McCormick meticulously searched for evidence of Stripe’s paid advertising by checking the most important search terms and found very few google search ads. Instead, Stripe focuses on brand, social media, and content:

- It has beloved API documentation world over

- Stripe Press publishes books and documentaries

- Increment is its engineering magazine

These marketing activities are more about making Stripe top of mind and credible for its target persona: developers. Since day one, Stripe has stuck to that. So, it has not invested in a giant sales force, like some SaaS companies.

Patrick, who we have heard from many times in the piece, is prominent in the media. In that sense, Stripe takes more of a Tesla approach to sales & marketing than most companies. It uses free channels and the charisma of its CEO. At its heart, like Tesla, Stripe still uses product growth as its main competitive strategy.

Lesson 10: Iterate on Ambitious Product Strategies

Part A – Iterate

In June, Stripe released two more new products: Tax & Identity. Tax is another way to help finance teams, by automating calculations. Identity is a whole new product. It opens up different engineering teams as potential customers, like identity or account teams.

Adding these two products onto the many other products we have discussed so far, it becomes clear Stripe has a huge footprint. It is selling to many developer teams in modern companies. In fact, it has 17 products. So, how do you understand them all?

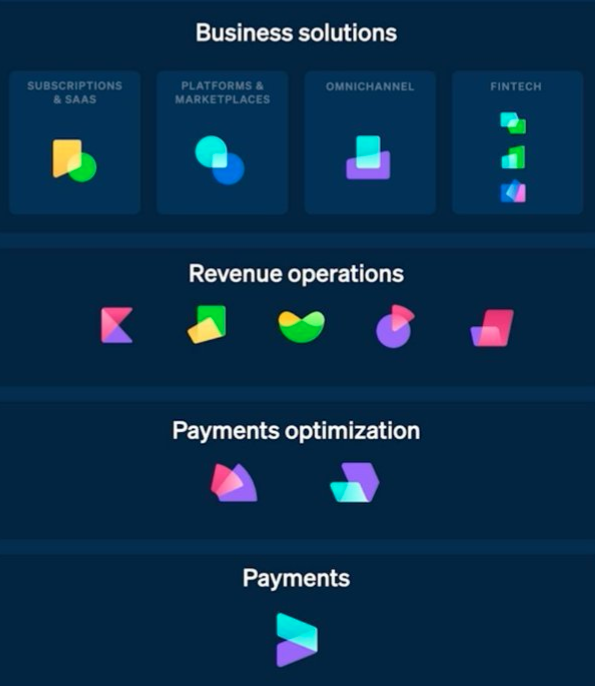

This is an important task for the product leaders in big enterprise companies. As the product bloats in scope, they must iterate on describing it. In particular, they must put together an inspiring strategy, with an easy-to-understand product framework. Stripe recently released just that. There are four key buckets of products Stripe builds, and they build on top of each other:

Breaking this down: at each layer, Stripe gets more ambitious. Layer 1, its core, is payments. That is the base of everything. Then on top of that comes Layer 2, the payments optimization products: Radar and Checkout. Layer 3 is revenue operations, which includes:

- Sigma: custom reports

- Invoicing: one-off invoices

- Climate: remove carbon as you grow your business

- Tax: automatic tax calculation

- Identity: identity verification

Finally, layer 4 is business solutions, which can be thought of in four buckets:

- Subscriptions & SaaS: the main product here is billing for subscriptions and recurring payments

- Platforms & marketplaces: the main product here is Connect

- Omnichannel; the main product here is Terminal

- Fintech, which has a few different products: Capital (business financing), Issuing (card creation), and Corporate Card

This provides a lens for the strategy to execute amongst individual product teams. We can imagine Stripe building within different layers, adding sections within layers, or adding layers.

It also gives the product team a structure. There will be dedicated payments optimization teams who deepen the payments optimization products for customers who do not go with Stripe’s core payments solution. Stripe will also have dedicated teams for each of the current revenue operations functions. Same goes for business solutions. That is the power of the organizing framework.

Part B – Ambitious

Not only is Stripe’s product strategy up to date with a new guiding framework, it is also very ambitious. There are so many more engineering teams Stripe now builds for. Yet the challenge with sprawl is putting something out to the market that is actually impactful.

How does Stripe avoid the trap of expansion without impact? Historicity. The team focuses on product visions that can last 10-30 years. One can imagine Patrick asks this question he has posed on Twitter, of his API designers:

Could this be a multi-decade abstraction?

Stripe is continuing to try to do that with every API it makes. It is building historic products, not just any products. The goal of Stripe is to change the internet forever.

Every product team can benefit by striving for that level of impact.

Reminder: Thoughts here do not reflect my employer, Affirm. I am just a newsletter writer. I have been studying Stripe for 10 years and collected 90 articles in my information capture system as research for this piece. 2 existing employees and 1 former employee provided feedback to ensure accuracy.